As seen in:

Check out Some of the Work that has Helped Our Clients Raise Over $5 Billion and Counting...

(scroll down to see excerpts from our decks)

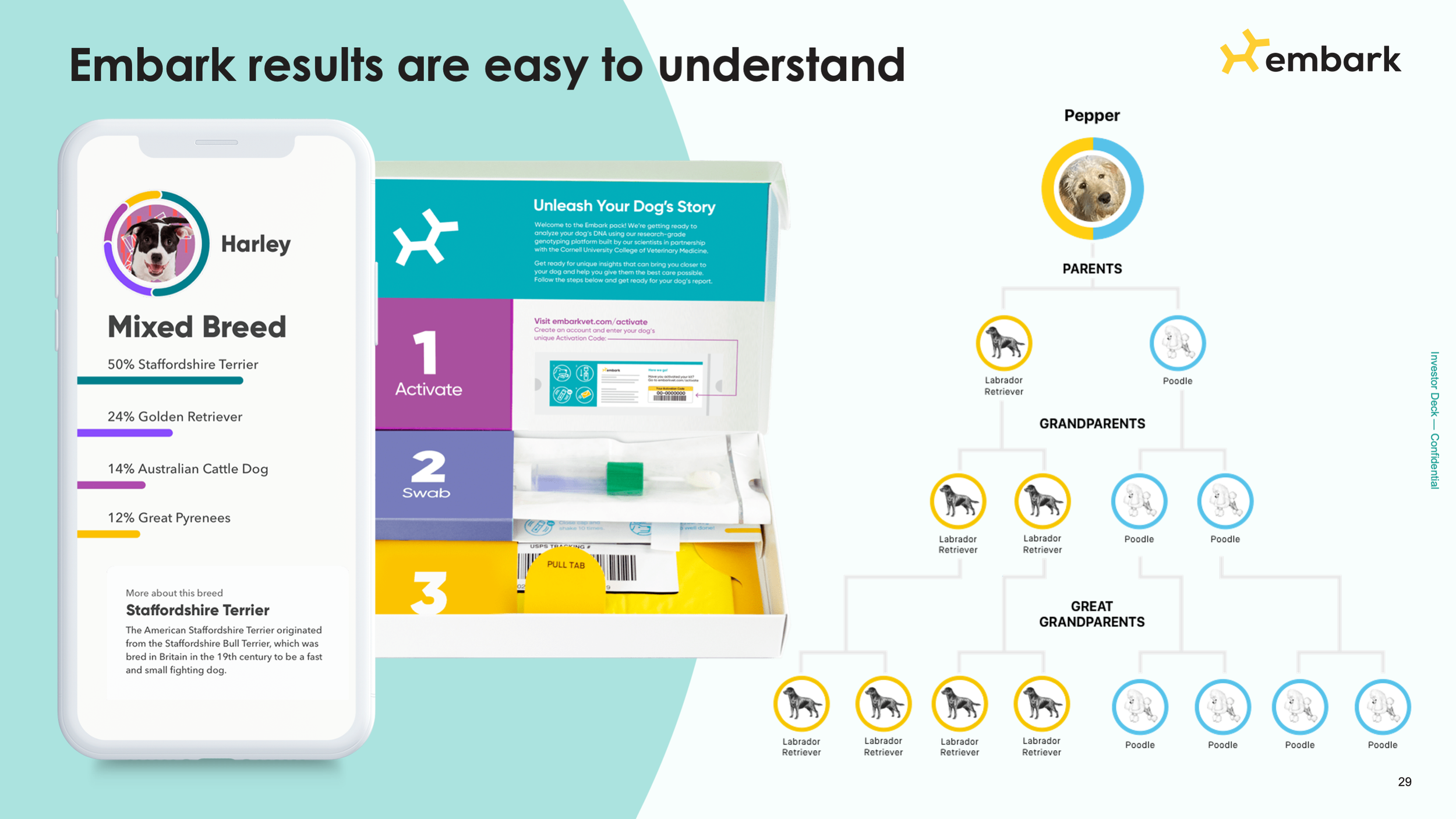

$75M Genetics Raise led by SoftBank

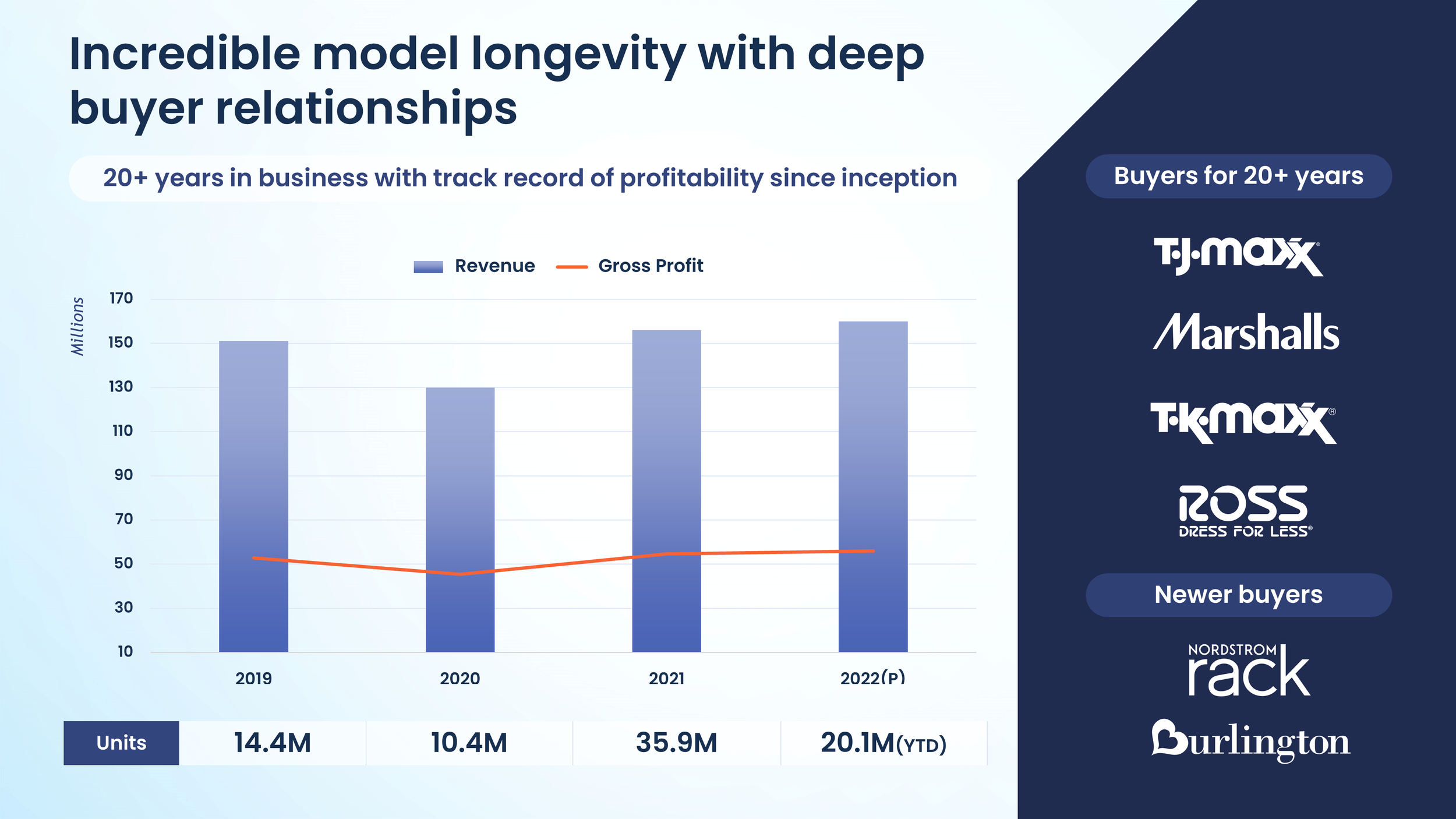

$700M B2B Services Nasdaq IPO

How Eterneva Co-founder Adelle Archer Raised a $10M Series A Round Led by VC Tiger Global (Mark Cuban Doubled Down Too!)

“Before we worked with Unicorn, we struggling with our deck. Since our last round, it had grown to over 50 pages, and the Series A investors we had soft-floated our round to needed a different narrative focus than our prior rounds: our story had to be less ‘visionary’, more KPIs and concrete growth strategy. We had gone through so many rounds of revisions on our pitch, but the story just wasn’t as impactful as it needed to be for the top-tier VC conversations we were going to be having – especially considering we’re category creators in grief wellness, a pretty specific niche.

So I started searching for someone to help. And when I’m looking around for someone to help our company do something with multi-million dollar implications like investor pitch coaching, I want the best. I am reading the reviews, I go deep in looking at what people are saying, and how they’re saying it – how was this person’s experience needle-moving for their company? Unicorn checked all the boxes.

We came into the Unicorn process looking for help shaping the deck and the pitch, but it turned out to be so much more. We were so blown away by the experience and the value that we got out of it, that we also hired them to run our Red Team exercise and Q&A prep. I could not recommend doing that more to other founders, because it’s not just about nailing that first pitch – you need to maintain that same level throughout your DD process with investors.

As founders with an existing VC investor base, we recognized that when fund raising, the stakes are so high, and we’re potentially giving up a significant part of our company as part of this fund raise. That has major implications for our investors and our executive team in terms of wealth creation and what their equity’s worth, so we owed it to everyone to put in the work so that we could look back at this process and say, ‘that was my best effort, I left it all out on the field in this Series A round.’

I’m so glad we worked with the best, and as a result we were able to shortcut the process and make sure our first pitch was really impactful. I’m really glad that we made this investment.”

Adelle Archer

CEO and Co-founder, Eterneva

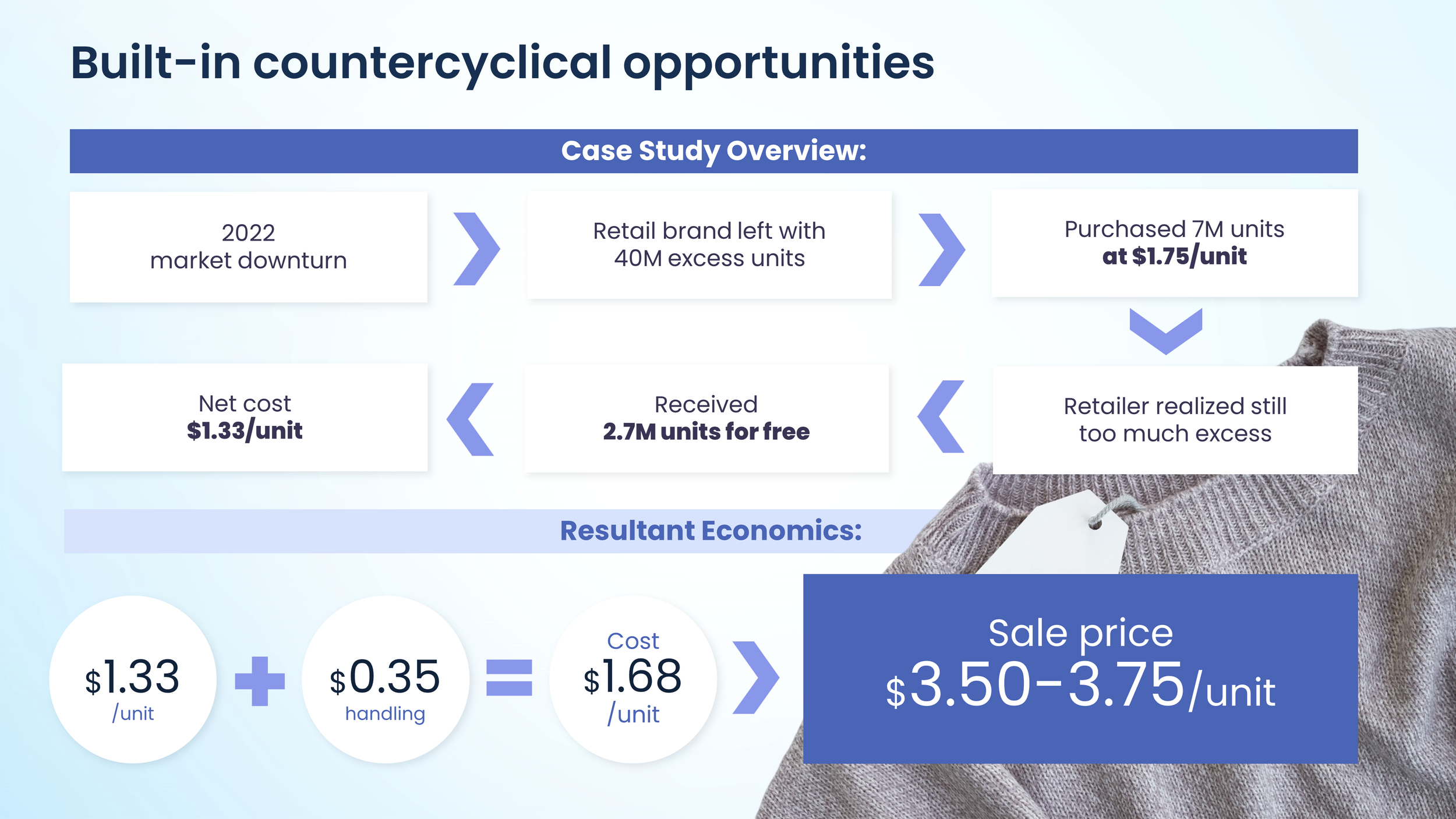

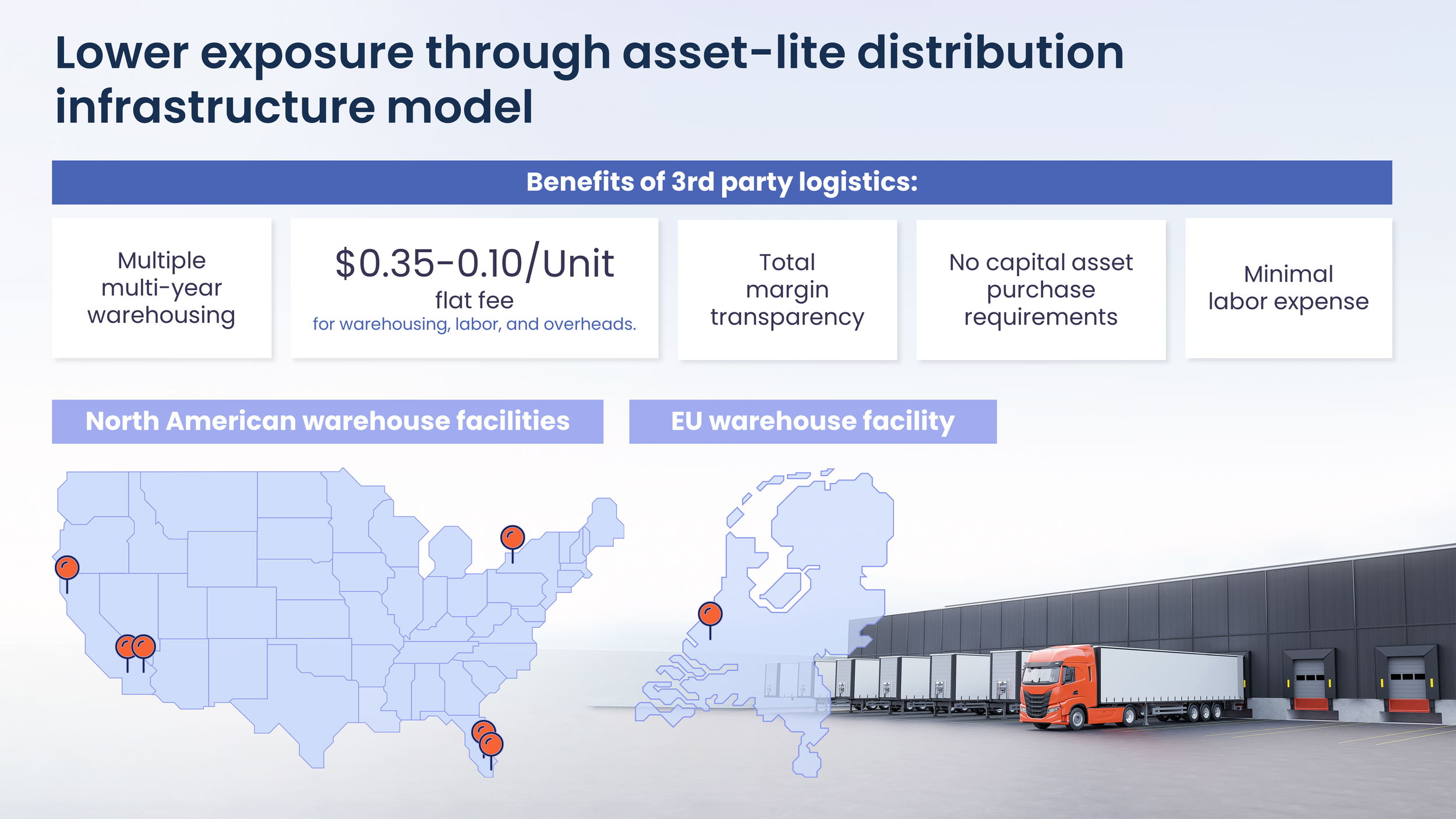

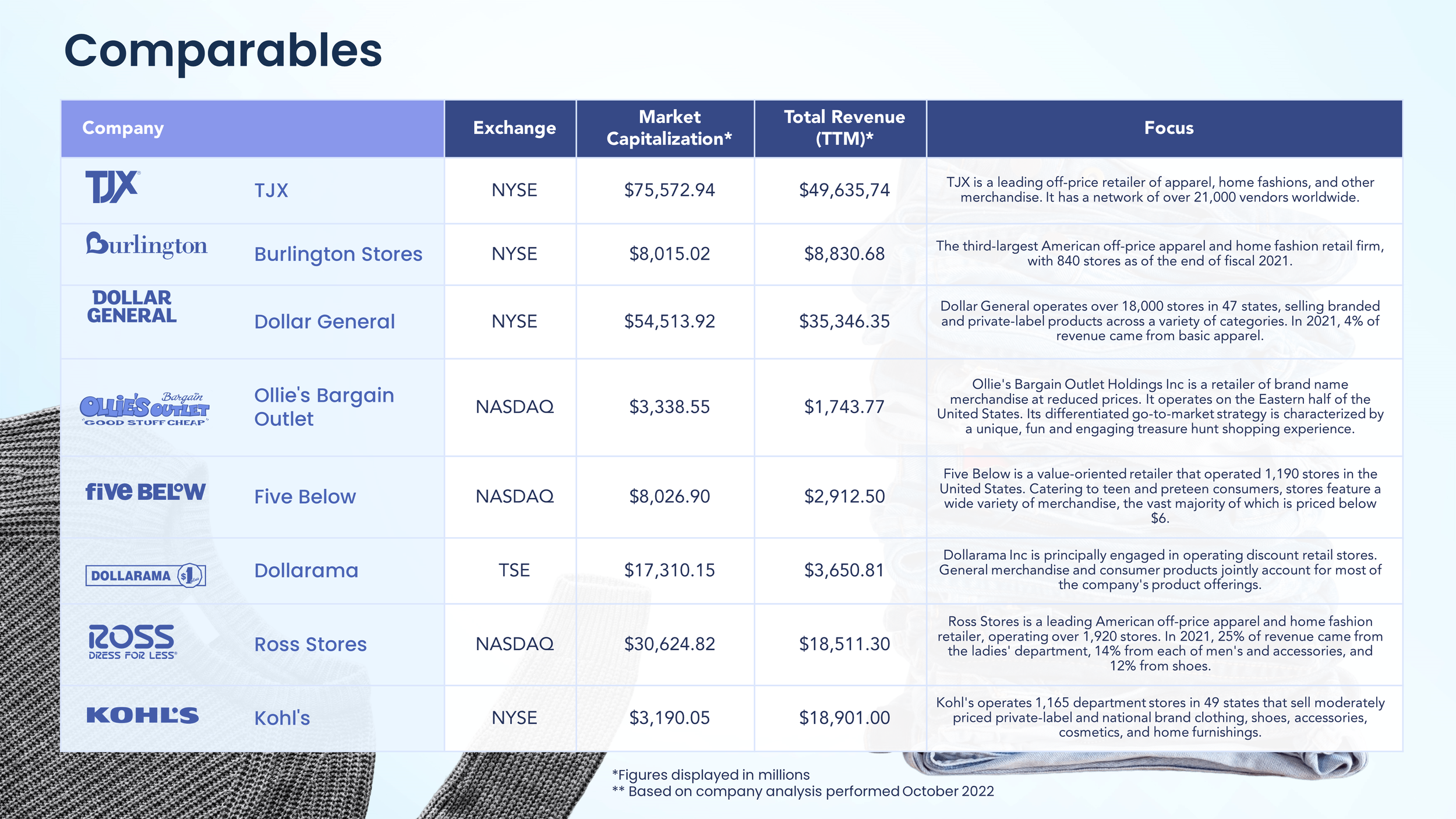

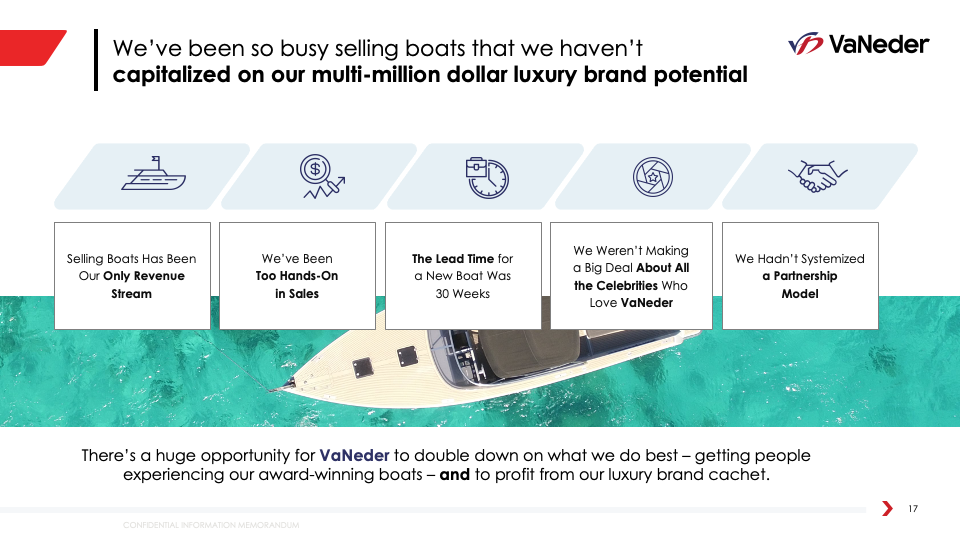

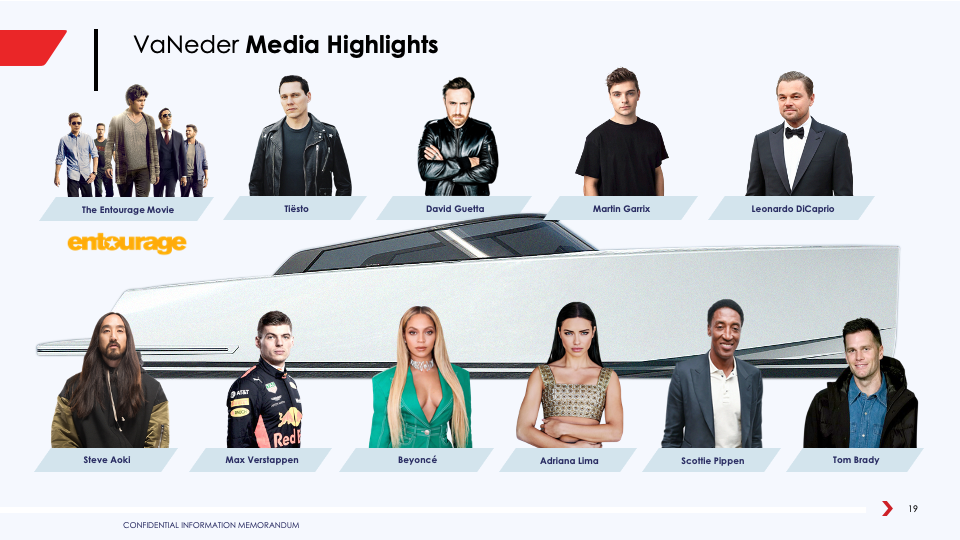

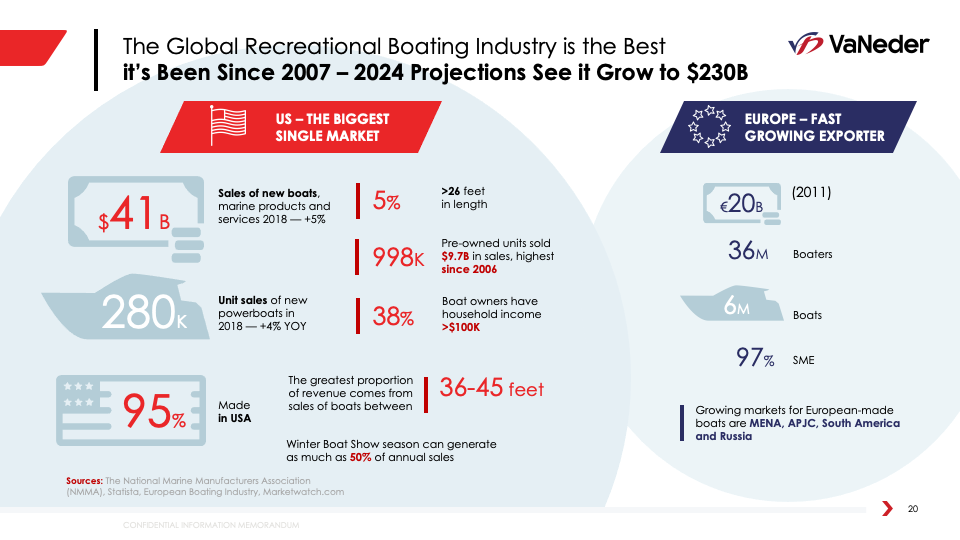

$100M Luxury Yachts Business (Successfully Exited)

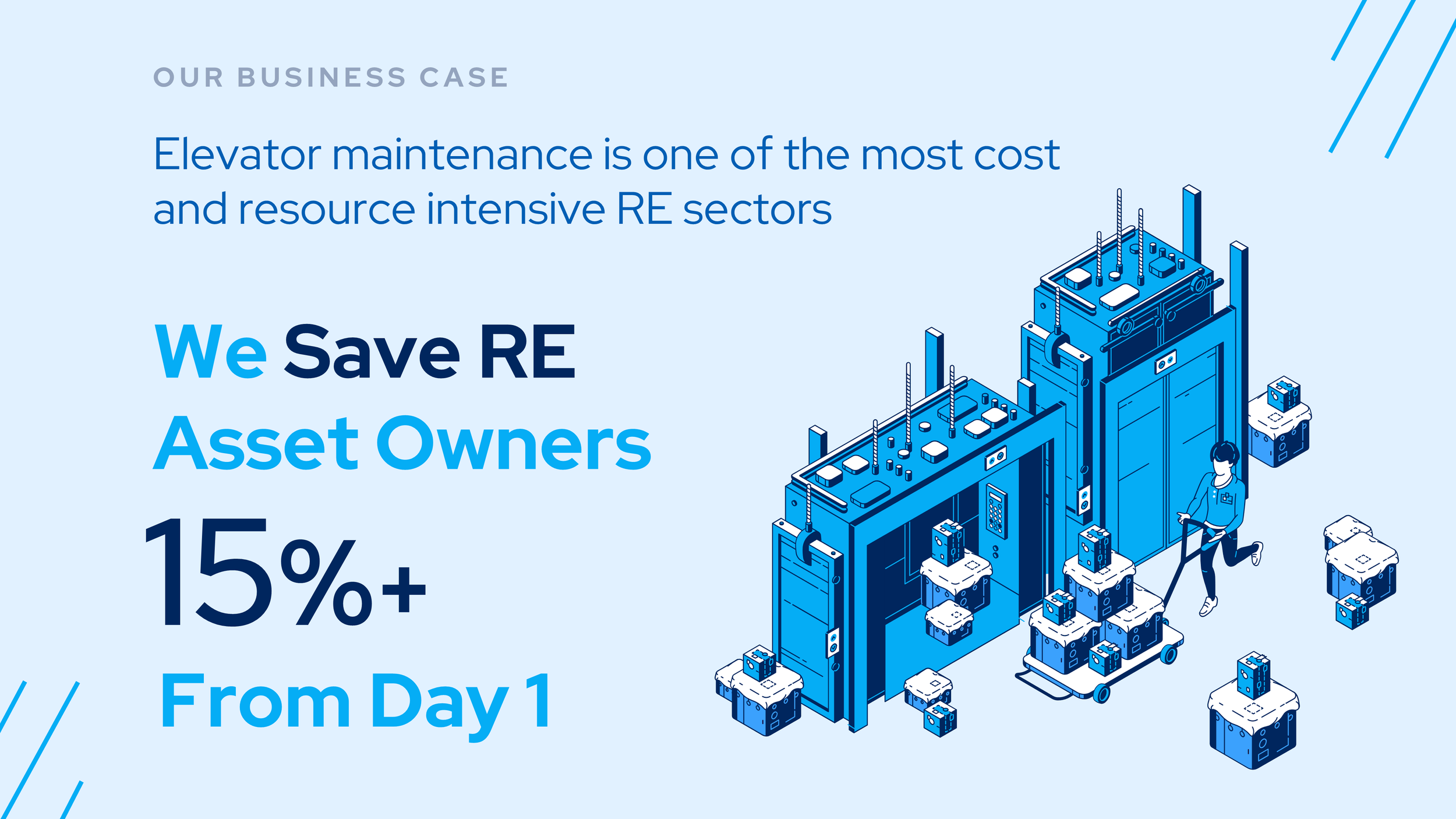

Successful $10M Proptech Raise Led by Corporate VC

Our Pitches & Plans Have Gone in Front of Some of the Biggest Investors on the Planet

How CEO Nancy Briefs Got VCs Saying: "BEST DECK EVER"

“I’ve raised capital several times before, and there’s a lot at stake when you go in front of investors. You need to have your story straight and clear - and your pitch must look excellent in order to maximize your effectiveness and likelihood to successfully raise. And that’s really important because having the right investors on board is crucial - teamwork makes the dream work.

Before working with Unicorn, we had gone through several iterations of the deck. It was ‘OK’ but it still needed work, because our story is simple, but the company is complex because we’re treating Type II Diabetes. And we needed Unicorn to help us tell the story clearly and visually without overwhelming investors with technical data.

Overall, Unicorn did a great job with our deck, to the point that when we presented at the JP Morgan RESI Conference in San Francisco, someone from the audience stood up and told us that it was the best deck he had ever seen, in front of everyone. It was really a great experience, we successfully raised $1,500,000 through the MIT alumni group and we’re still using Unicorn’s work today.”

Nancy Briefs

CEO and Co-founder, AltrixBio

$93M Fintech Raise

$50M Franchise Raise

Case Study:

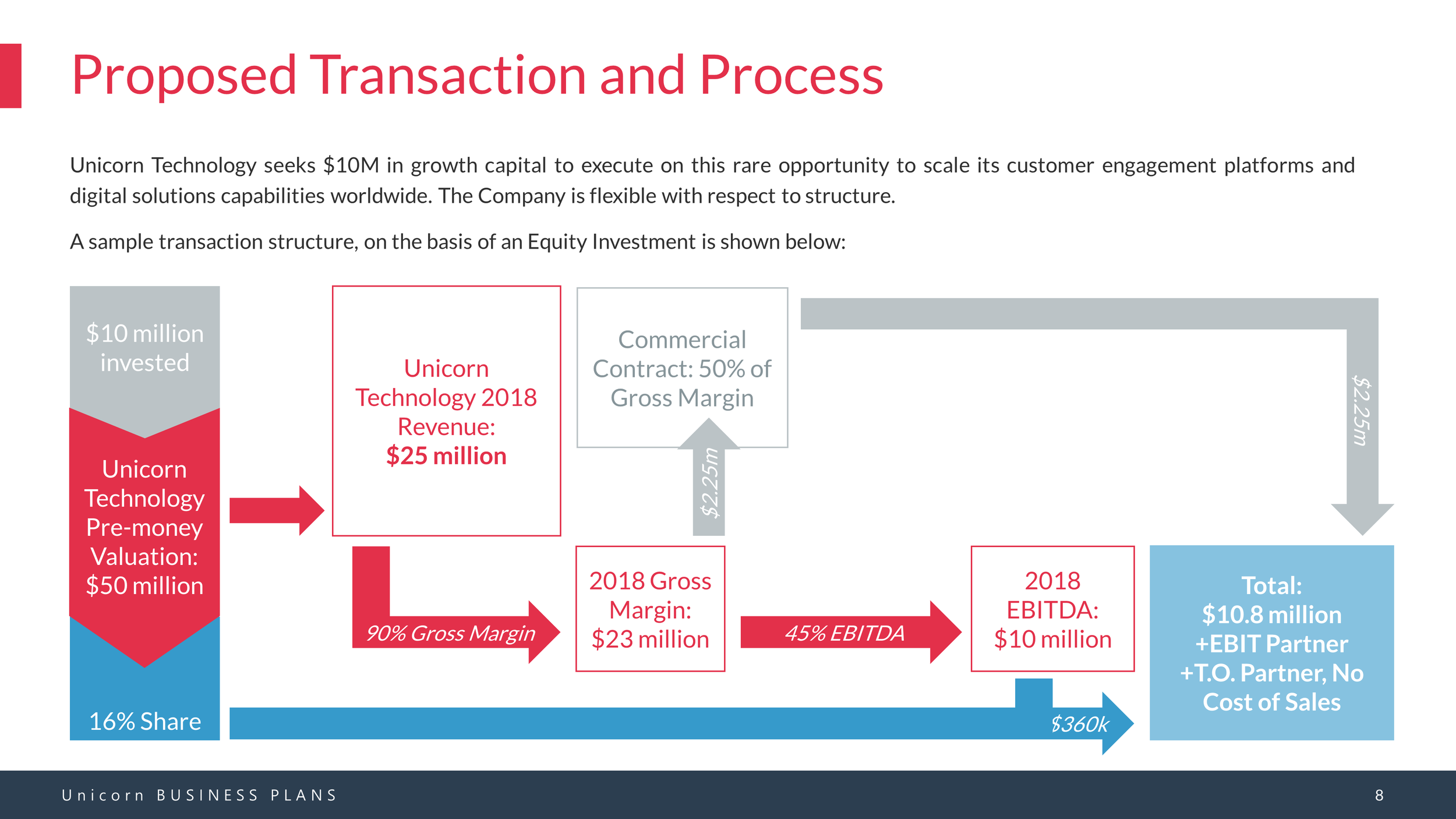

OVERSUBSCRIBED: How CEO Brandon Metcalf Raised $2.25M In 3 Short Weeks - Multiple Termsheets From Investors Who Previously Told Him 'No'

"I founded a business previously, and we had raised over $28 million for that business, but it was all from angel investors that knew us, so we had never actually put together a proper institutional pitch deck.

I wanted to do an institutional round this time around, but had never done it before. We had a solid base to work from, but having past capital raises and exit history actually means you get scrutinized even more by investors, and you’re expected to know what you’re doing.

I tried to create a few pitch decks, and I just couldn’t get the messaging right. We couldn’t figure it out – the first few drafts were really rough. We started approaching some investors and because the story wasn’t clear, it opened us up to a ton of questions from investors, which turned into getting off-track in the pitch and ultimately not getting the deal closed.

That's when I came across Evan and Unicorn. In our first call, they just "got" the concept of what we were doing, and very quickly we were able talk through “What really is the pitch.” The process of defining our pitch was crucial – we still use much of the same messaging in how we talk about our business with clients and other investors.

If I would have entered our Seed round with the deck that we had, I would never have closed the round.

But because we worked with Unicorn, we were actually able to go back to investors who previously said “No”, and they turned around and said “Yes” . I think the fact that we were able to close our round oversubscribed from people who said “No” previously, within 3 weeks, with MULTIPLE termsheets, that says everything you need to know about Unicorn.

That’s why I keep referring people from my network to them. They look at building a deck from the eyes of your prospective investor and deliver an awesome product."

Brandon Metcalf

CEO, Place Technology

$10 Million Raised in 8 Weeks with Mobile App Pitch Deck

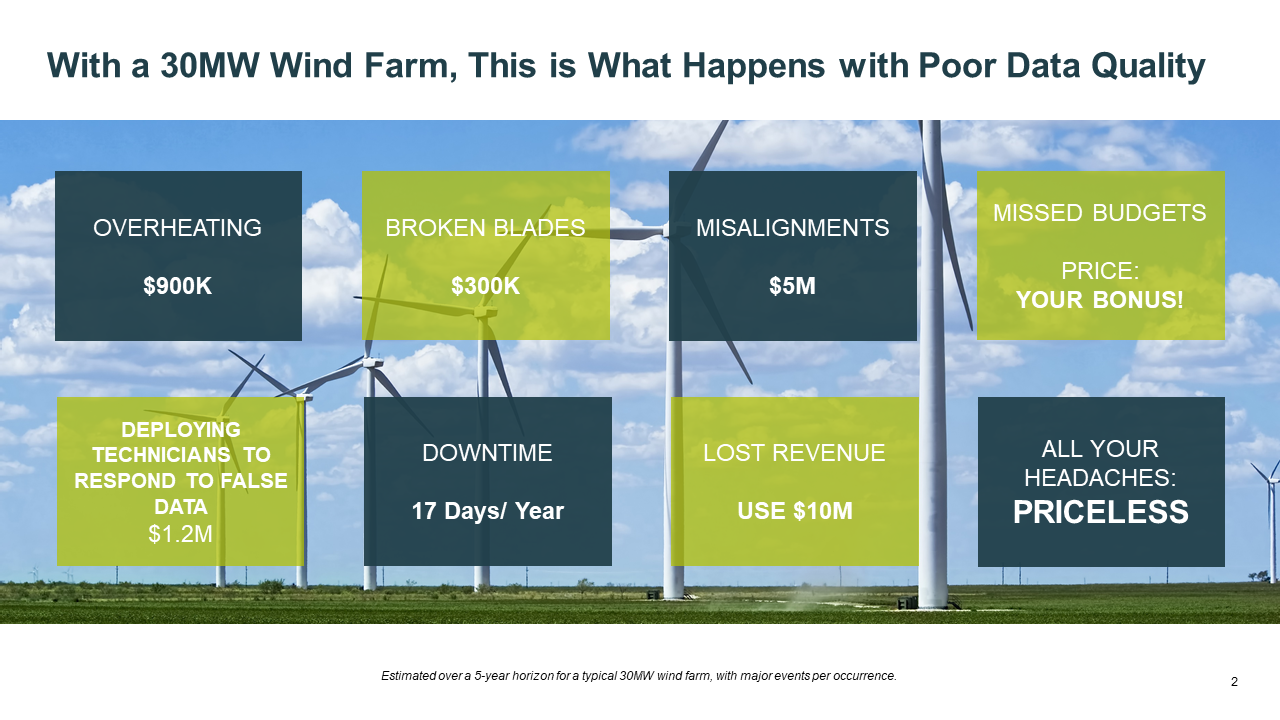

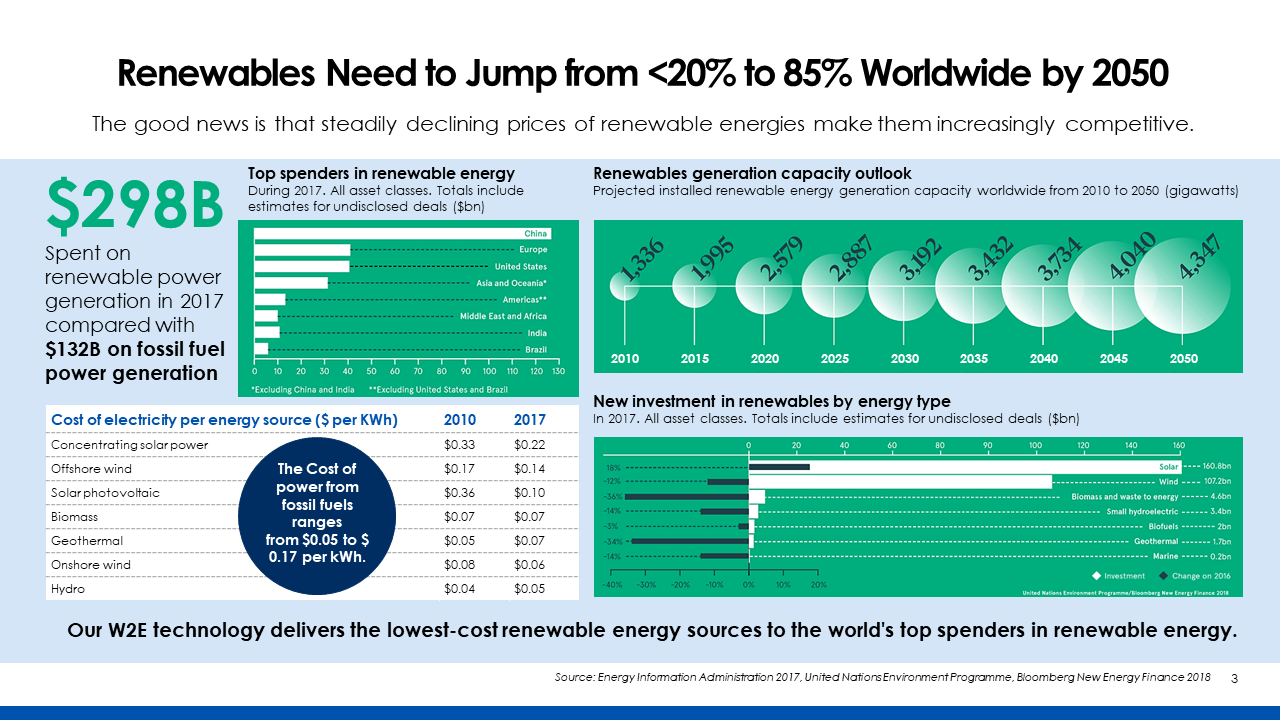

$15M Wind Power Raise - Greentech Pitch Deck

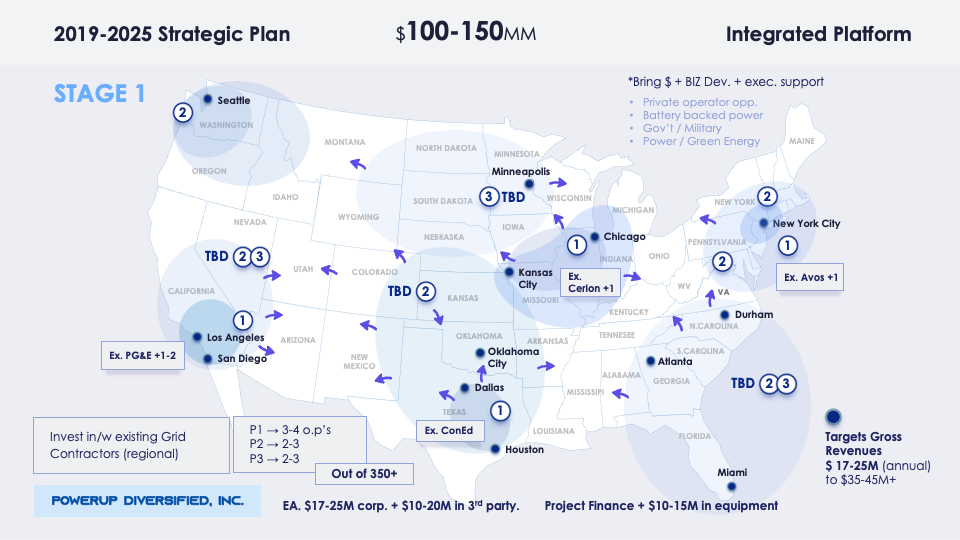

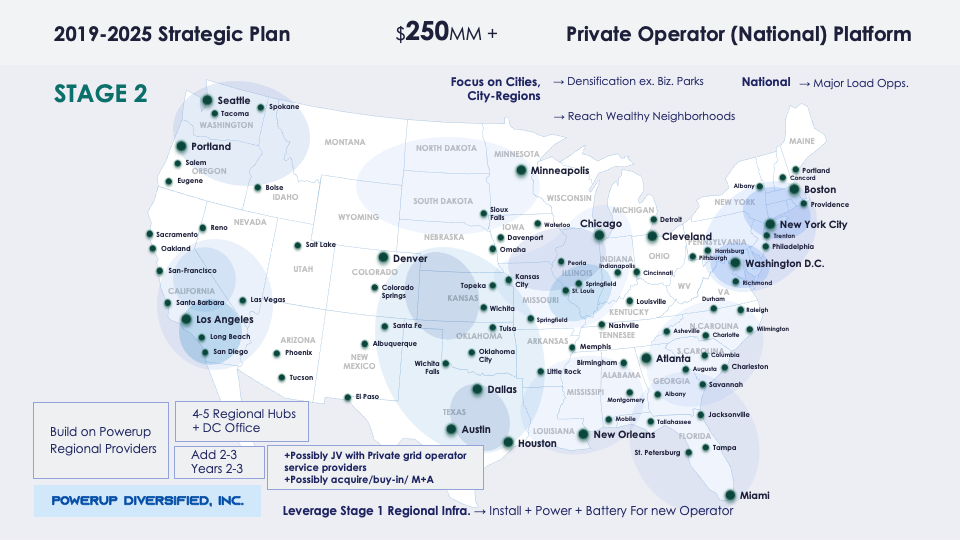

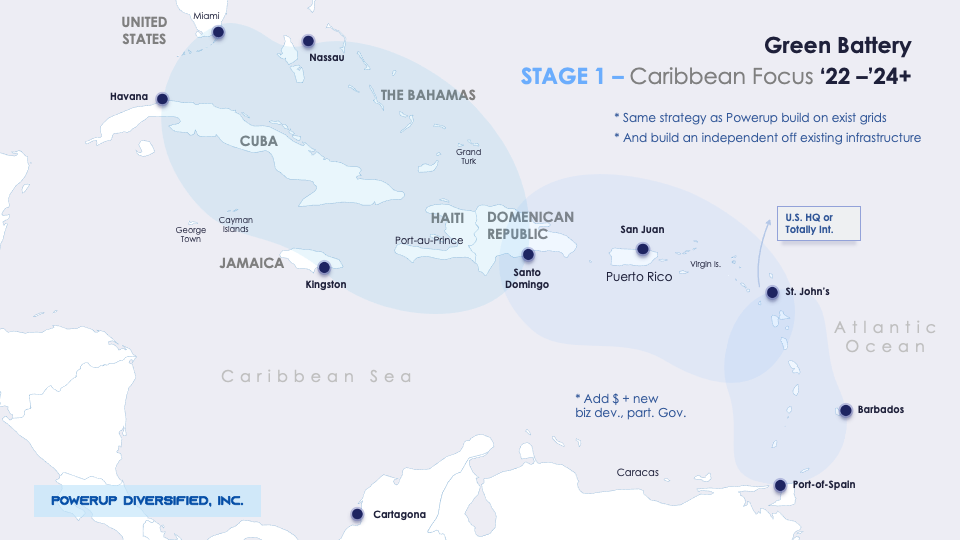

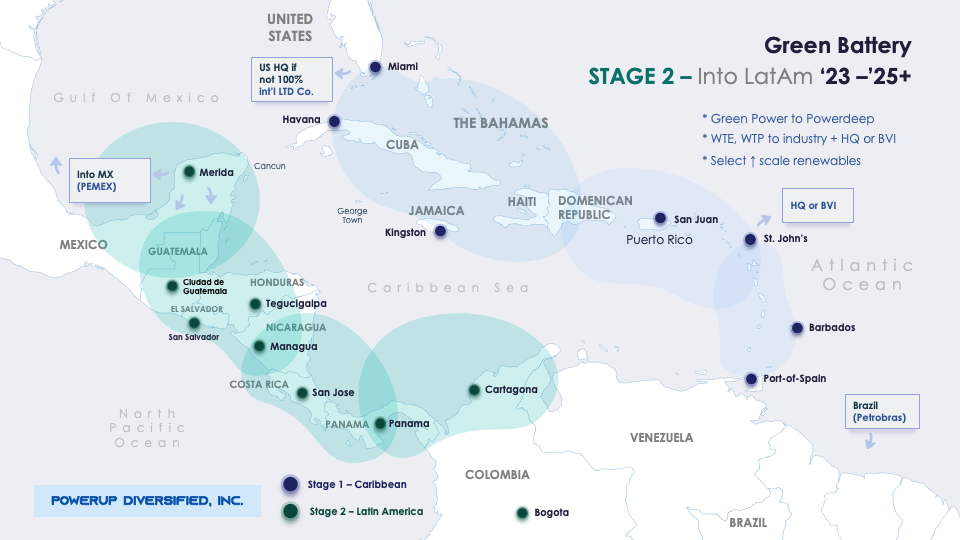

$250M Energy Sector Rollup

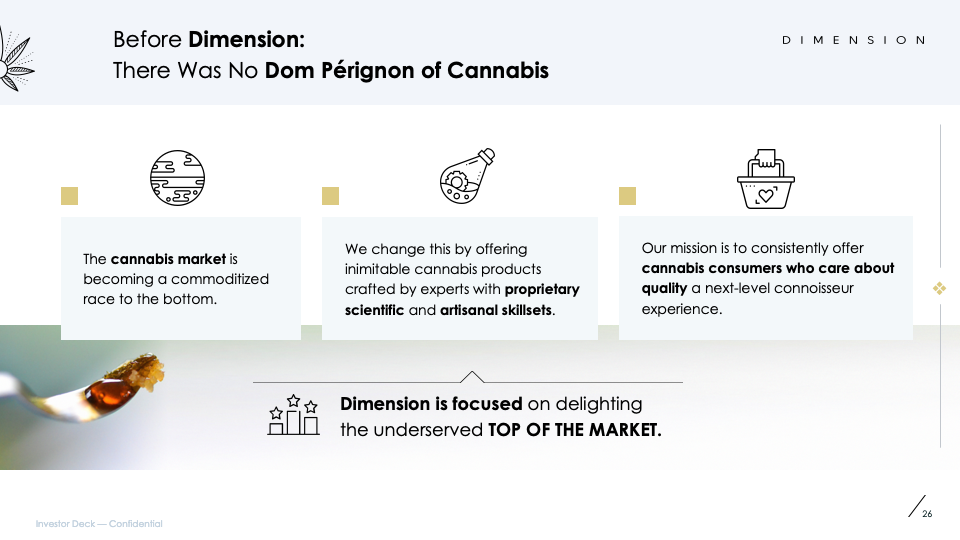

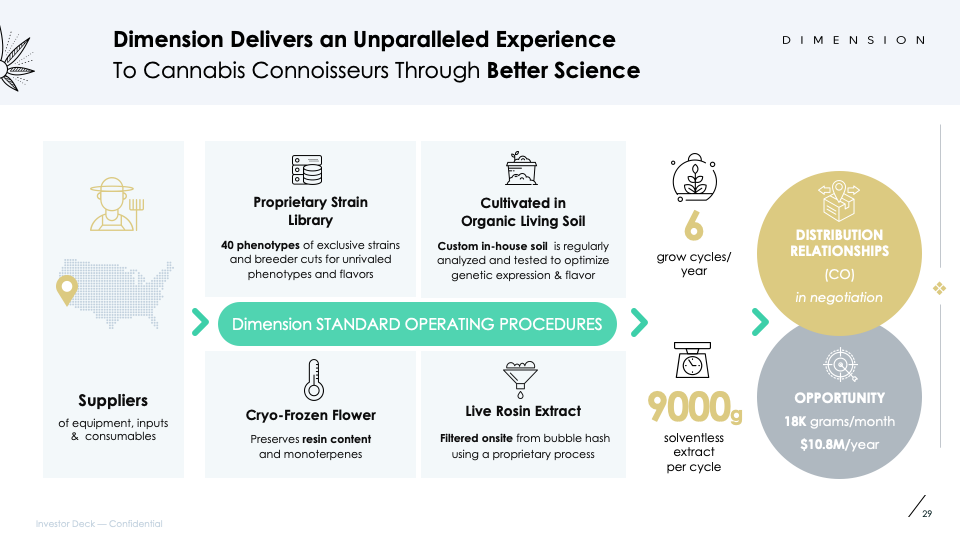

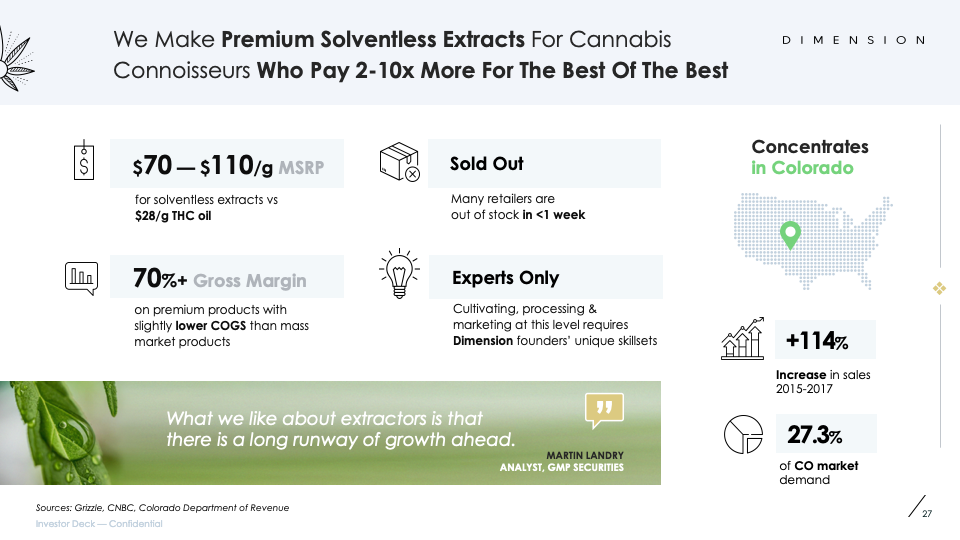

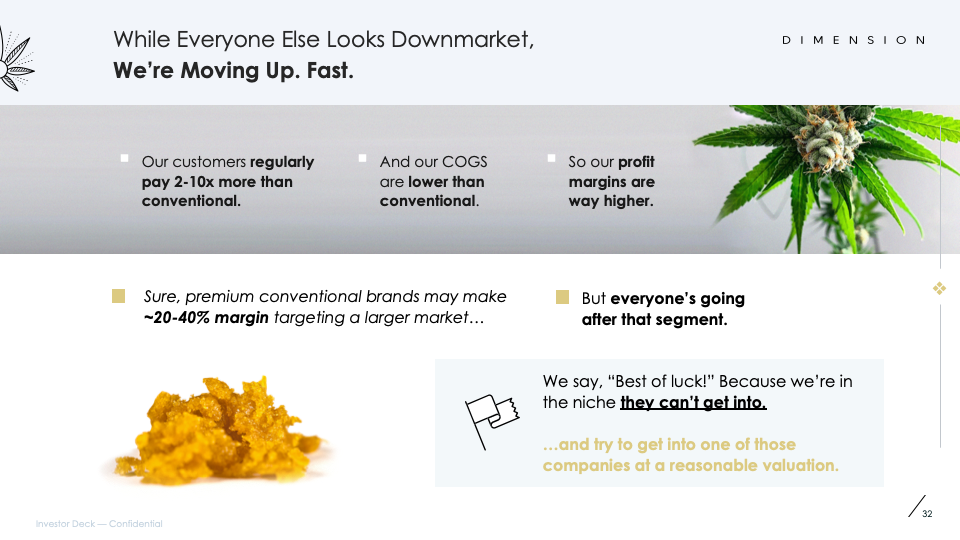

Premium Cannabis Brand - $10M Raise

WAIT, WHAT?! Apparently Silicon Valley VCs Are Talking About Us...?

Luxury B2B Pitch Deck - $15M Investor Fund Raise Deck

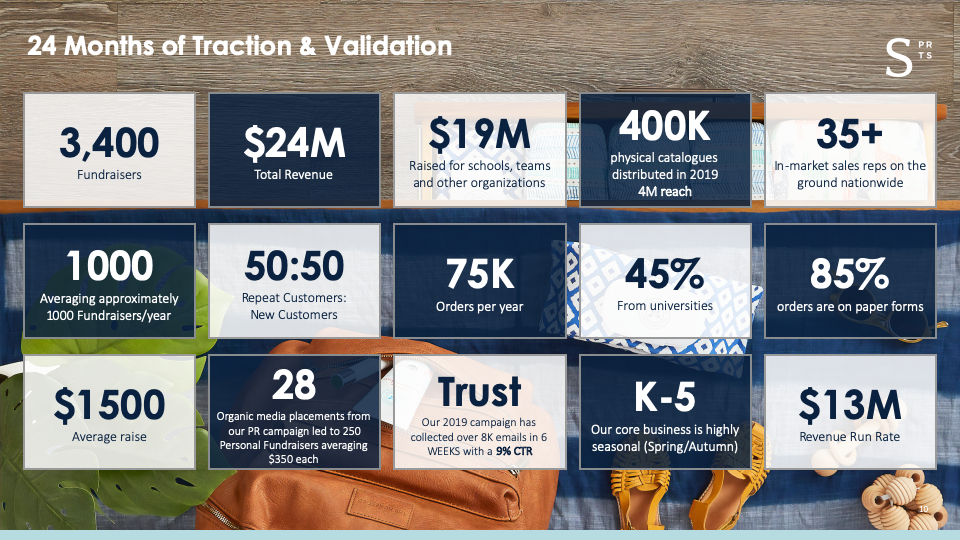

Consumer Goods SaaS Pitch Deck - $10M Raise

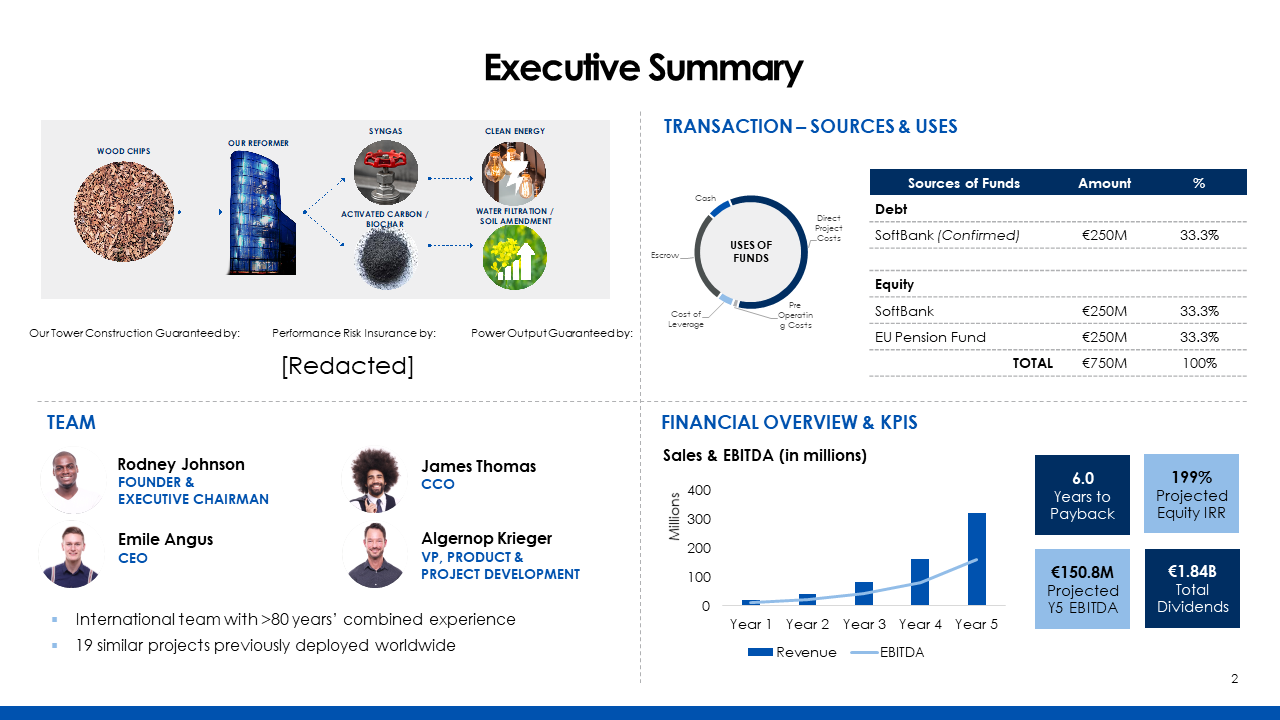

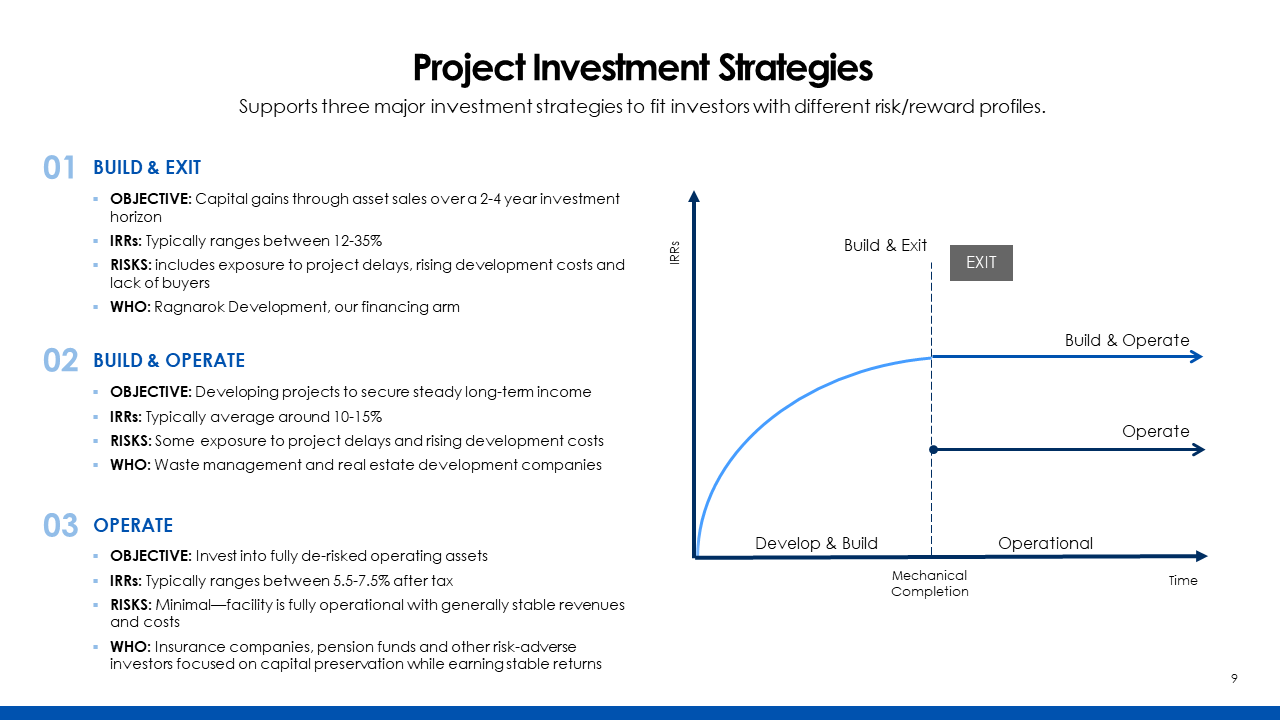

Greentech Deck: Waste-to-Energy (W2E) Investor Memorandum for Successful $750M Raise

How Edward Chien Took Chick 'N Skin From Bootstrapped to Fully Funded in Only 2 Pitches - and Is Now 10Xing His Business

“Coming into this raise, I had never raised before, I wasn't sure if we were ready. I knew we had to grow, but it was a question of, "is now the right time, can we make this happen"? It just came to a point, where we said "Yes we're doing this" and it was time to put together our investor pitch and business plan.

Before working with Unicorn, we did a lot of research on who we should be working with. But once we got on the phone I instantly knew that these were the right guys for the job.

We're super happy with the work that Unicorn did. They just did a really high-quality job, concise, great graphics, story was really solid. The first time we pitched an investor wasn't awesome, but on the second pitch we did a really good job, and so the investor signed up. This was in the middle of COVID, which was actually great because now we have time to build up our operations during some semi-quiet time.

We actually had a list of like 100 investors to approach... we had two meetings total. We didn't even go after the other 98. And with the money that we raised we're going to 10X our business."

Edward Chien

CEO and Co-founder, Chick N Skin

www.chicknskin.com

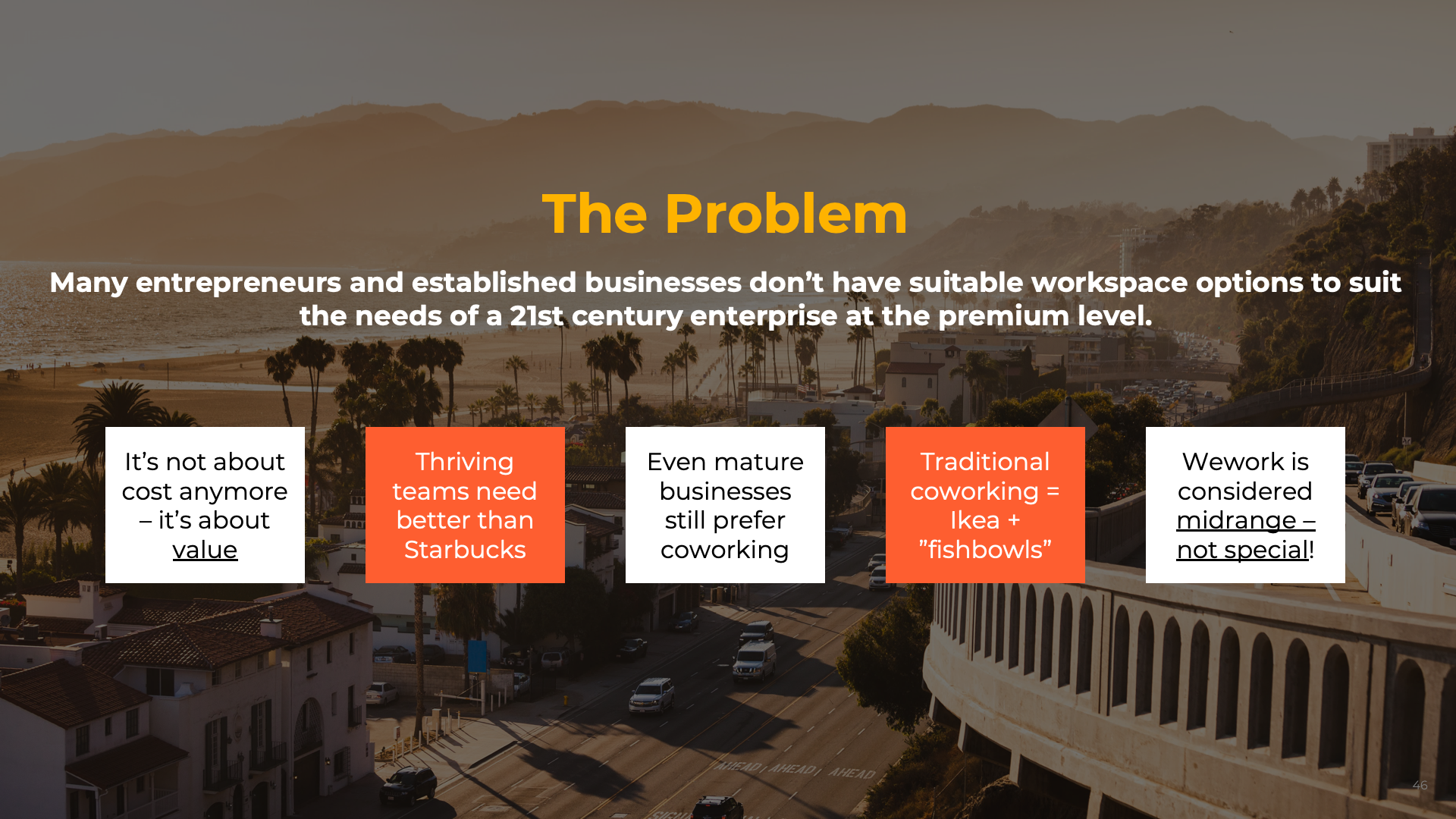

Luxury Coworking Space Pitch Deck

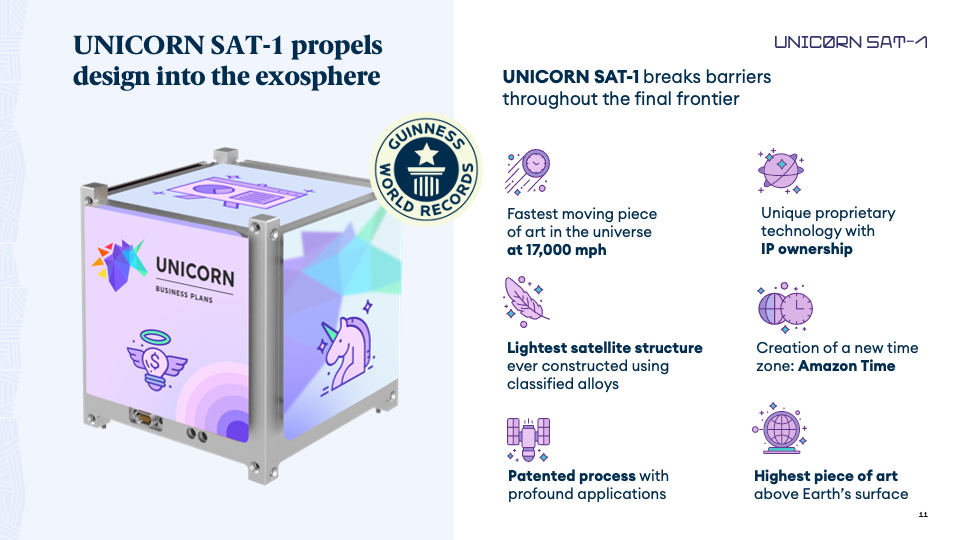

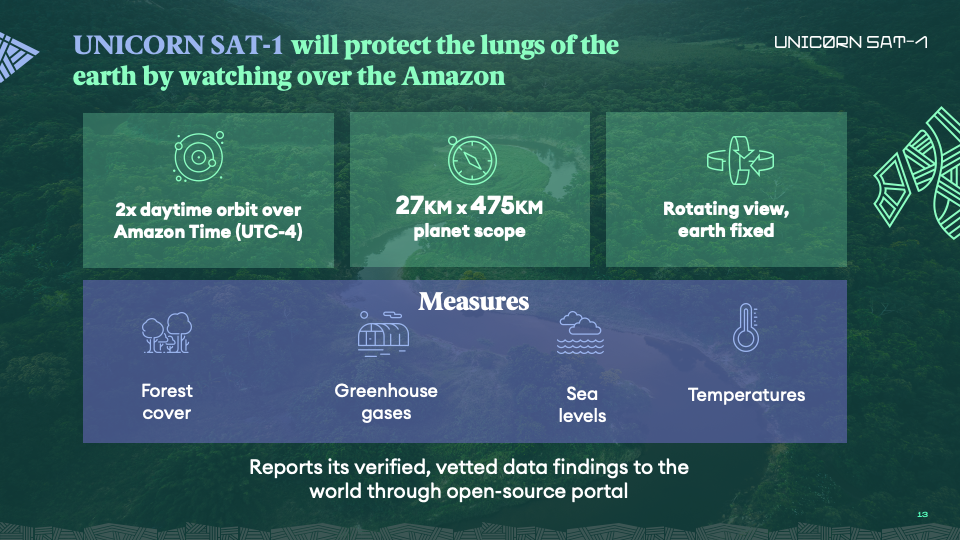

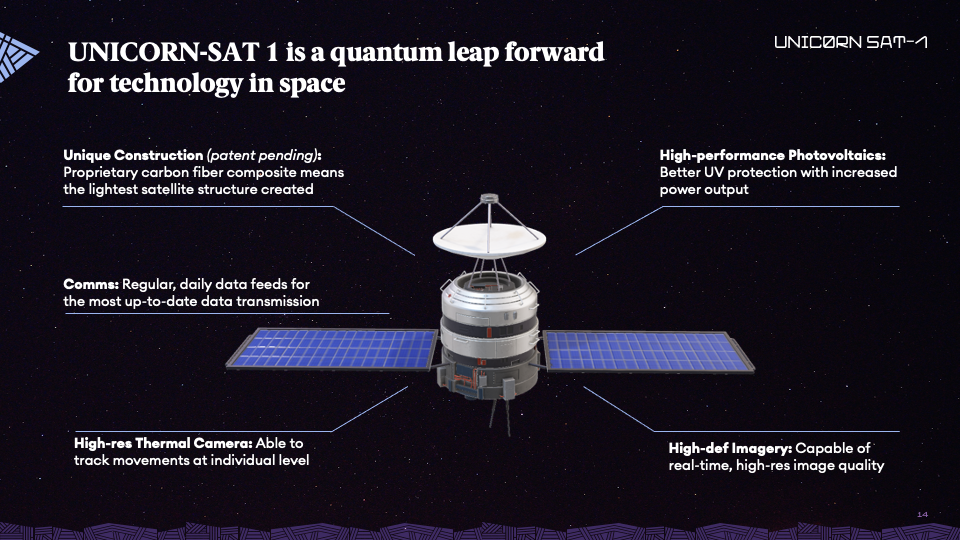

Aerospace Pitch Deck - $20M Raise for Satellite Launch

Did We Mention?

Our Pitches & Plans Have Gone in Front of Some of the Biggest Investors on the Planet.

INVESTOR PERSPECTIVE: How Simon’s New Deck Attracted Investors… And Then MULTIPLE ACQUISITION OFFERS

“As someone who has raised several times, I can say unequivocally: you really have to get the right advice, early on when you’re raising institutional capital.

Before working with Unicorn, we had put together a pitch deck that wasn’t really impactful. It was ‘good’ but it really was not getting the job done, and wasn’t what we wanted to show to potential investors. Once we went through that process with Evan, it was just a complete 180 in the sense that we had so much more confidence.

So we put it in front of investors, and they got very interested very fast. Ultimately we decided we didn’t want to go forward with those investors – because we were in control at that point – and it actually turned out that we got multiple acquisition offers. Job well done.”

Simon Quirk

Investor and CEO, VidVersity

www.vidversity.com

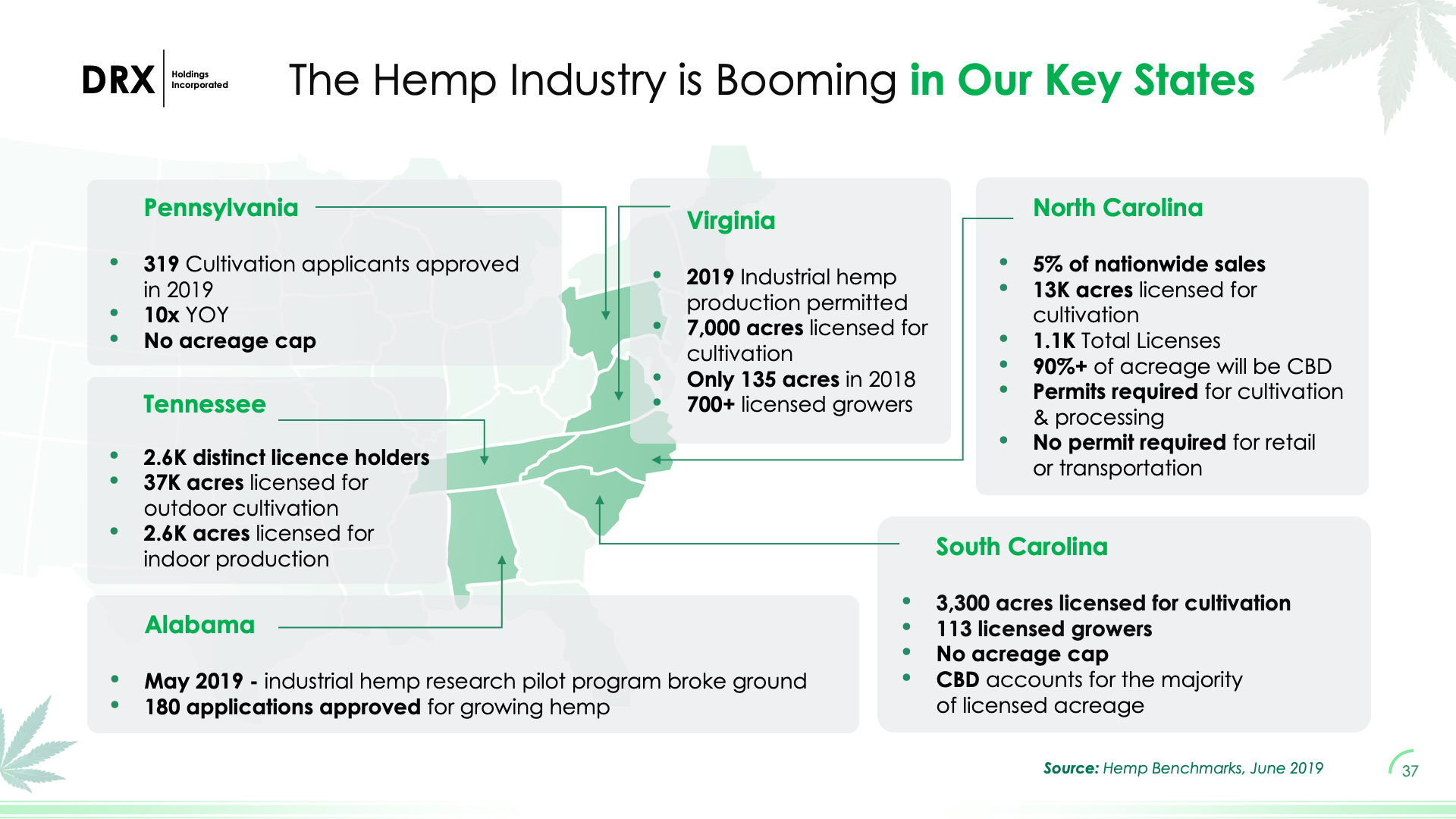

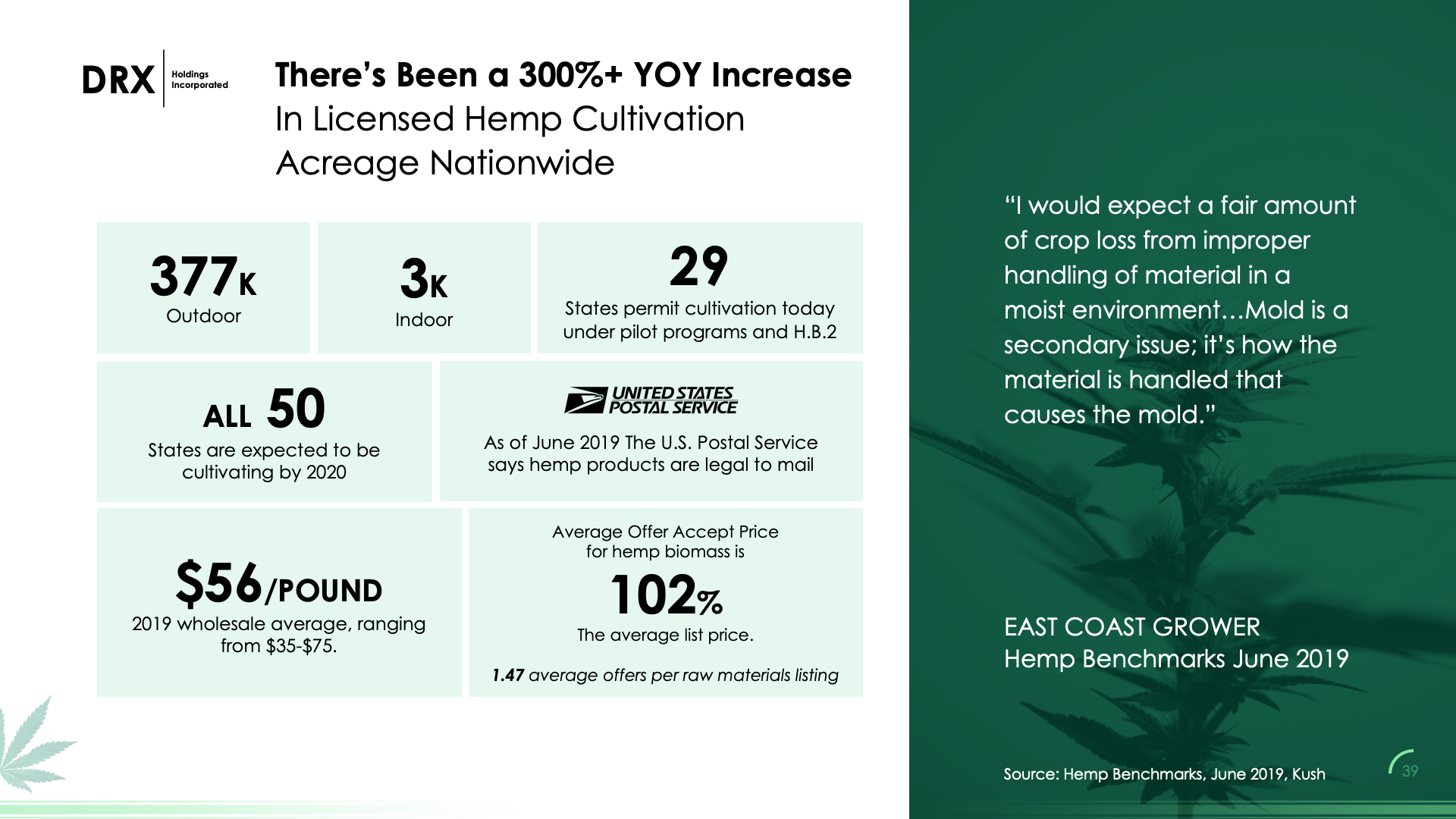

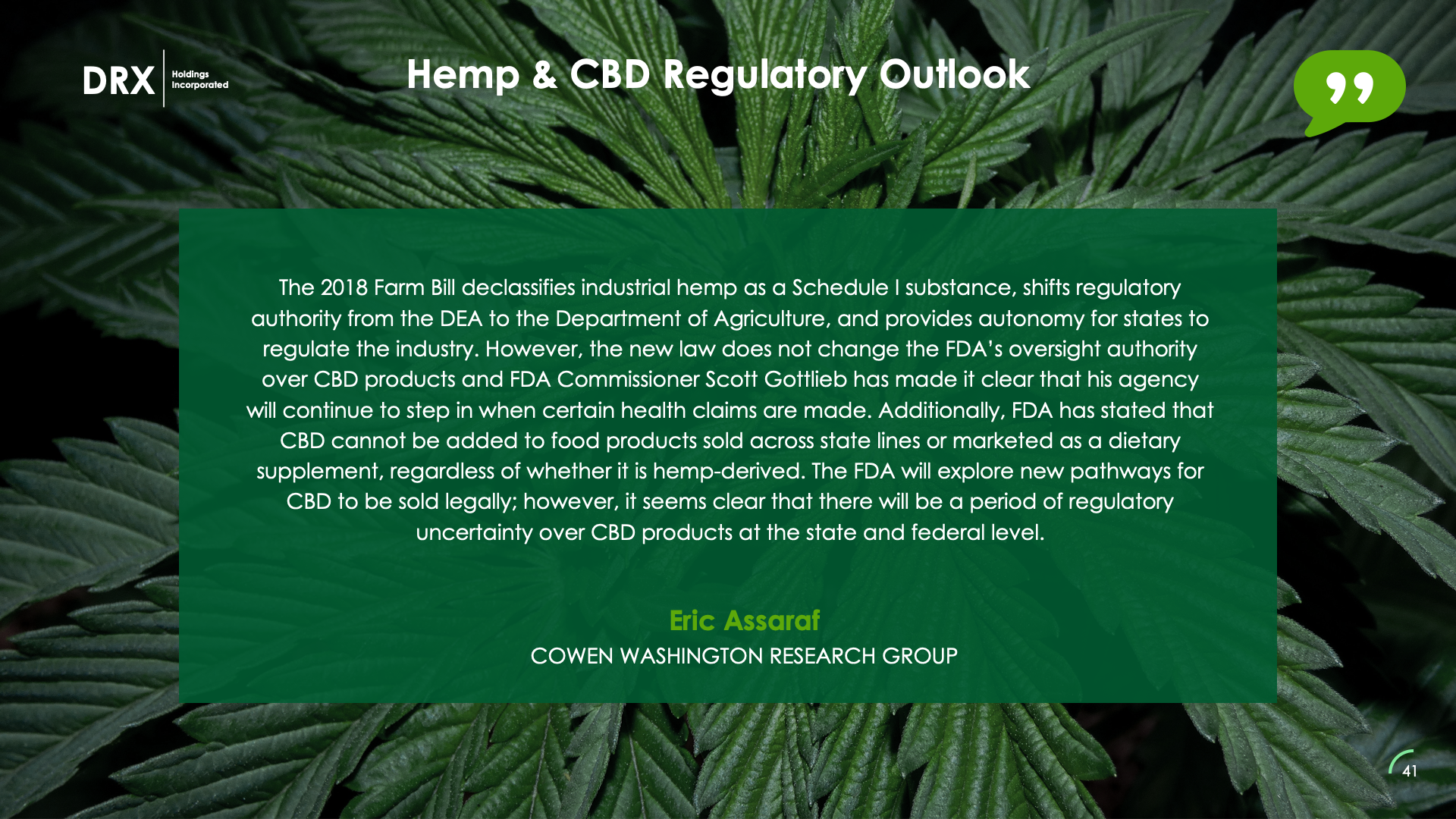

Commercial-Grade Hemp Business Plan

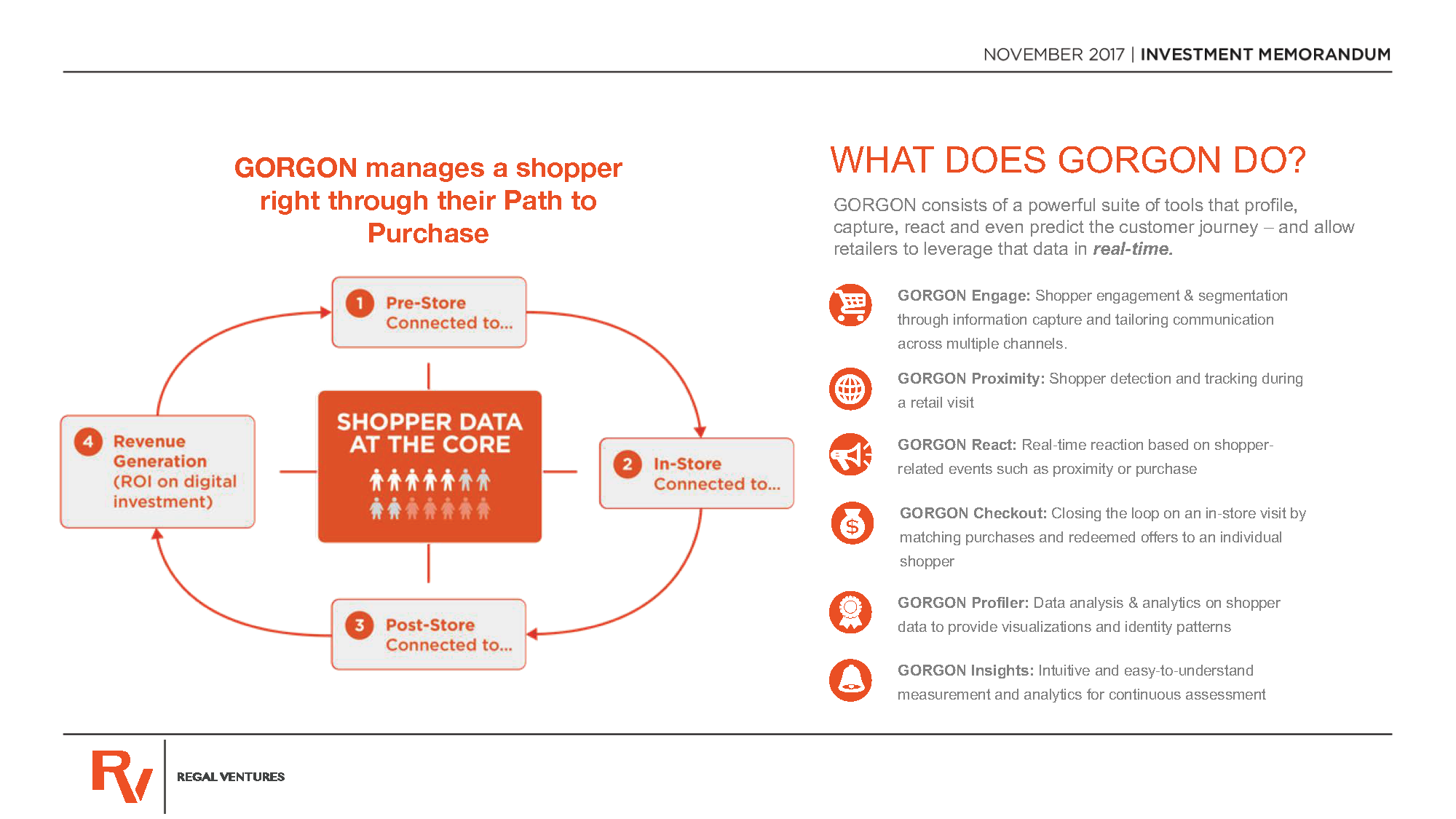

MarTech CIM - $10M Raised

How Founder Dom Giacona Approached a $2.1B VC Fund Who Said... "THIS DECK IS INCREDIBLE - WHO BUILT IT?!"

“This whole process was really amazing. Coming into our capital raise, we actually had no problem on the dev side of our business… we actually built all the software pretty fast for our MVP. But then taking that message to investors, we wanted to have the absolute best foot forward. And so we wanted to work with the best in the country, and that’s when we found Unicorn.

Before working with Unicorn, I actually put a mockup deck together. But there’s no way I would have ever sent our old deck out to serious VCs because it just wasn’t anywhere near what we wanted to show in terms of our value as a business. We also had some holes in our story, hadn’t fully worked out our revenue model. So we had some work to do.

All I can say is, when a $2.1B VC loves your deck, then you must be doing something right!! And when you get asked to ‘Please upload your deck’ and you’re like… ‘Yeah I got what you want to see…’ it’s just a whole other level of confidence.

The entire process with Unicorn was awesome. I was blown away by the turnaround speed, the video walkthroughs were amazing, the advice was unparalleled… we’ve come so far by working together, and NO ONE is going to touch our decks going forward except Unicorn.”

Dominic Giacona

Founder, RoadShield

www.roadshield.app